TM

Teslanomics

Fiat vs. Tesla Model S

TM

5-Year Cost of Ownership:

Tesla Model S vs Fiat

In the table below, cost of ownership is estimated for the purchase of new 2011 and 2012 Fiat cars and the Tesla Model S. The purpose is to compare your estimated cost of ownership for 5 years to a Fiat vehicle you may potentially buy, to that of a Tesla Model S. Here, cost of ownership is calculated by adding the following:

Adding the estimated 5 year cost of fuel, cost of maintenance, cost of repairs, and the loss of value (depreciation) of the vehicle gives us our estimated ownership costs for a vehicle after a 5 year period.

Our sampling of numbers is obtained using Edmund’s TCO (True Cost of Ownership) Calculator. At this time, we are unable to account for insurance cost differences because we don’t as of yet have insurance data for the Tesla Model S. We hope to have this as we approach the July 2012 release date and will at that time include that in our calculation. We also are not accounting for differences in taxes and fees since those vary too much from state to state and we are estimating costs based on a sample of data for only 1 zip code in Los Angeles, California.

Our Total ownership cost calculation does not include financing costs because it is too variable. We don’t know who will need financing and if so, how much. Here is some guidance, however, that will enable you to add it to our calculation based on your own individual needs.

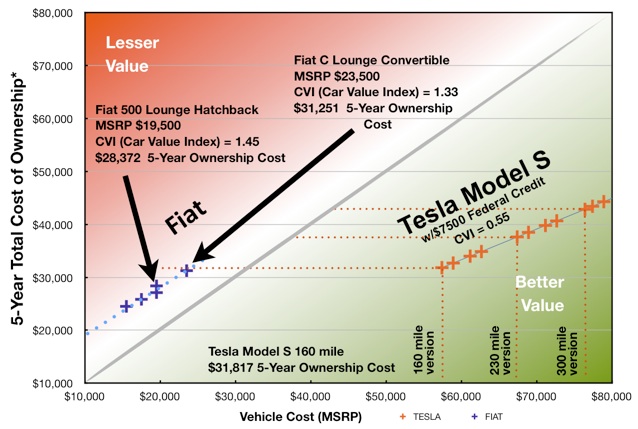

The graph above compares the 5-year cost of ownership for all of Fiat’s current vehicles. These are all 2012 vehicles. Please refer to the table below to see which specific models and variations thereof are being depicted in the graph.

The most interesting thing you’ll see is that all of the Fiat vehicles are clustered in a pattern that form a diagonal line. There seems to be almost a 1:1 relationship between the price (MSRP: Manufacturer Suggested Retail Price) of a Fiat and what it costs to own it for 5 years, but upon closer inspection, the ownership cost is about 33% to 58% higher than the car price! Dividing the ownership cost by the car price reveals the true relationship, that is, what is the cost of ownership for 5 years vs its sticker price? (The diagonal gray line represents a 1:1 ratio where the car price would be equal to the 5 year ownership cost, but no cars lie on this line). You’ll also observe that the ownership cost of the new Fiat 500 Lounge Hatchback is just $3,445 lower than the cost of the Tesla Model S. $3,445 is a nice chunk of money, but when you consider that for that small difference which really is 18% more that the Fiat’s price of $19,500, you end up with a car that costs 3 times as much!

If you look at the table below, you’ll see that the price of the Fiat 500 Lounge $19,500 while the ownership cost is quite a bit higher at $28,372. How much higher? Let’s calculate it.

$28,372 5-Year Ownership Cost / $19,500 MSRP = 1.45

Thus, the Fiat 500 Lounge has an ownership cost that exceeds the price of the car by 45% since it is 1.45 times greater. This number is very useful. It reveals that the Fiat 500 Lounge is more expensive to own for 5 years, than it is to buy by almost another 50%. You can see graphically, that all the Fiat automobiles have ownership costs that are a bit higher than the price of each car. This is reflected in the average Car Value Index of 1.49 displayed in the table above.

5-Year Ownership Cost / Price of car = Car Value Index

We found this index useful too in comparing cars to each other. It reveals car value. Basically, if a car costs less to own than its price, then its clearly a better deal, that is, of course, if the car is priced fairly based on its style, options and features. So we gave this index a name. We call it the “Car Value Index” , or “CVI”. A CVI below 1.0, means the car is cheaper to operate than it is to purchase, or more expensive to operate than it is to buy if it is is greater than 1.0. You can read more about it here: New Car Value Index Reveals Best Deals. The convertible version of the same Fiat, the 500 C Lounge Convertible, for example is a better buy since its CVI is the lowest for all the Fiats at 1.33. Thus, it cost 33% more to own for 5-years than its MSRP.

A Car Value Index of 1.45 is pretty high for a gasoline-fueled car. The Fiat 500 Lounge has an expected depreciation rate of 66% in 5 years, so it loses 2/3 of its value in that period of time. That’s pretty bad and in fact almost as bad as some Saab, Mercedes and other Audi vehicles that lose 70% of their value within that same time period. Just for the sake of comparison, somer cars from Nissan are expected to lose only 37% of their value. The Fiats have an average cost for maintenance and repairs that approximate $4,800, which is pretty good. That’s not nearly as bad as some vehicles that have repair and maintenance costs that approximate $16,000! Nevertheless, The Tesla Model S is clearly a better value with a Car Value Index that is at .59! However, does it make sense to compare the Model S to a small car like the Fiat 500? Probably not, but if you’re buying a Fiat 500 because you only want to spend $20k, you should be really looking at your cost of ownership to begin with, rather than the $19,500 sticker price of the car. You may realize that for not much more money, you could have a nicer car and you may even enjoy that car for even a lower cost of ownership if you hang on to it for a longer period than 5 years. This will, however, depend on the difference in cost of insurance. We don’t know what the cost of insurance will be on the Model S, so for now, we can’t add that to our calculation.

In the table below, depreciation is displayed in the “DEP” column. “MSRP” is the Manufacturer Suggested Retail Price. The “SAVINGS” column reflects how much you would save in a 5 year period by purchasing a Tesla Model S instead of the Fiat on that line.

The Tesla Model S is cheaper to operate than any of Fiat car models and configurations. Their cars cost anywhere from a bit over $22,500 to about $45,000. Ironically, the Fiat Lucerne Super Sedan and the Enclave SUV both approximate $45,000 in price--$12,000 less than the cost of the Tesla Model S, but their ownership cost both exceed the ownership cost of the Tesla by about $20,000!

Interpreting the Data

COST OF OWNERSHIP DETAIL FOR Fiat VS TESLA MODEL S

(MSRP for Tesla Model S below does not include $7,500 Federal Tax Credit)

HAVE COMMENTS OR QUESTIONS? WE LOOK FORWARD TO HEARING FROM YOU.

Select a different car manufacturer:

Fiat vs. Tesla Model S Graph

5-Year Ownership Cost vs MSRP

PRICE

RANGE

$15,500

to

$23,500

5-YEAR

DEPRECIATION

CAR VALUE

INDEX

1.49

MAINTENANCE & REPAIR INDEX

3.00

65%

Would you rather drive a $19,500 Fiat 500 Lounge or

drive a luxurious $57,400 Tesla Model S Sedan?

It only cost an additional $3,500!

ADDING FINANCING TO YOUR COST OF OWNERSHIP

On Tesla Motors’ website, their financing link, reveals that financing is available from Bank of America if you are purchasing a Tesla in the United States. Interest rates being quoted by Bank of America are 2.74% for a 60-month loan, and 2.99% for a 72-month loan. Since we are examining a 5-year ownership costs, lets consider financing costs using the 60-month term loan. Payments at that rate would be $187.54.

($187.54 per month) x 60 mths = $10,712

Thus from that $10,000 you are borrowing, you will end up paying an additional $712 in interest. If you you are comparing the cost of a $30,000 car to the $49,400 (after federal tax credit) price of a Tesla Model S. You would have to borrow about $20,000 more to pay for the Model S since it costs almost $20,000 more than a $30,000 car. The additional cost to do that would be:

($712 of interest per $10,000) x 2 = $1,424

So you would add $1424 to the total ownership cost for the Model S.

DEPRECIATION: LOSS OF CAR VALUE

If you were to sell your Fiat, you’d get the price you paid, minus that loss of value (depreciation) that occurred within that 5-year period. For the purpose of this comparison, we used 58% depreciation for the Tesla Model S suggesting that the Model S would lose more than half of its value after 5 years. This was based on Edmunds.com estimate of 58% depreciation on the Nissan Leaf (which is also an EV). We think, however, that the loss of value for the Tesla Model S will be less because these cars, with their low maintenance and their cheap cost for fueling, will be very desirable in the used car market (as observed today with the used market for 2003 Toyota RAV4 EVs) while the resale value of gasoline-based vehicles will continue to diminish over time as they become less desirable. Also, the Tesla Model S from the perspective of styling, cargo space, and ability to travel further per charge makes it a more desirable car than the Nissan Leaf.

COSTS NOT INCLUDED IN ESTIMATE

Please note, this calculation does not take into account differences in insurance costs and real maintenance and repair costs since we don’t know what those are as of yet for the Tesla Model S. It does not take into account taxes and registration fees nor cost for financing; so it does not reflect all potential costs. Also, these estimates are based on pricing in Los Angeles. Repair, maintenance, and fuel costs in different parts of the country will vary somewhat. Electricity costs vary in different parts of the country as well, and they are particularly high in the state of Alaska and especially in the state of Hawaii. This will, however, give you a great perspective on difference in costs of ownership on a high percentage of overall potential costs. To see more specific details on financing and insurance and to get cost of ownership that reflect the zip code you live in, please visit Edmunds TCO.

Please use this as a guideline only. By reading this, you acknowledge that not every possible scenario has been factored into these estimates since some data is unknown and depreciation and fuel costs are speculative based on past depreciation data and on forecasted fuel costs. Actual depreciation and actual fuel costs will be unknown until the time comes. Any decision you make to purchase a Tesla Model S, you understand that you do at your own discretion.

Copyright © 2012 TeslaRumors.com All rights reserved.

Tesla Model X: What to Expect on Feb 9, 2012

The Signature Model S is now Sold Out!

New Car Value Index Reveals Best Deals

The Signature Model S has a $3,550 Premium

Model S Options and Pricing Observations

Modei S Options may be disclosed on Dec 15

Tesla Reinvents the Car Buying Experience

Did I realy just buy a car online?

Tesla Opens 3 News Stores in Malls

TeslaRumors.com is not affiliated with Tesla Motors, Inc.

The Tesla Motors logo is a registered trademark of Tesla Motors, Inc.

All other trademarks are the property of their respective owners.

TM

VISITORS