Can you afford to buy a Tesla?

Can you afford NOT to buy a Tesla?

Explore this page of EV-Economics that we like to call “Teslanomics.”

Can you afford to buy a Tesla?

Can you afford NOT to buy a Tesla?

Explore this page of EV-Economics that we like to call “Teslanomics.”

Teslanomics: The Economics of owning an EV (electric vehicle)

Teslanomics

TM

TM

5-Year Cost of Ownership

Select a Car Make from this Pull down list:

TM

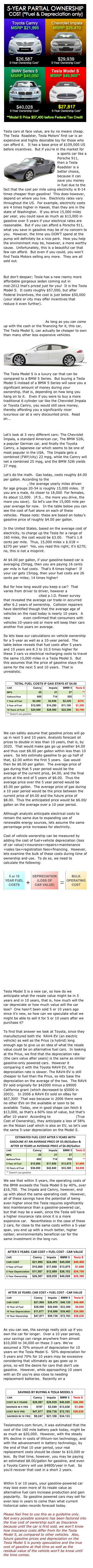

5-YEAR Total-Cost-of-Ownership* (T.C.O.) Range for all Cars per Manufacturer

*(based on cost of fuel + depreciation + maintenance + repairs)

Lowest T.C.O. for car manufacturer is for their most economical car

= T.C.O.* for Electric Vehicles

= T.C.O. for Hybrid Vehicles

= Low to High range of T.C.O. for all cars per manufacturer

Which cars offer the best value?

TESLA MODEL S vs. OTHER MANUFACTURER CARS

(Tesla Model S is a much better value than all other gasoline-fueled cars)

Would you rather drive a $19,000 to $32,00 car or a $57,000 Tesla Model S

They both cost* the same

(*Ownership cost does not include insurance cost differences)

How much value do hybrid vehicles really offer?

Scroll down to read the following sections:

Teslanomics: The Economics of owning an EV

5-Years Cost of Ownership

Tesla Model S Average Estimated Cost/Mile in your State

Which cars offer the best value?

How much do hybrid vehicles really save?

What happens after the $7,500 Federal credit is terminated?

Analysis coming soon.

What happens after the $7,500 Federal Credit Disappears?

Analysis coming soon.

Thank you for your support

Owning an electric vehicle is cheaper than owning a gasoline-powered vehicle. The reasons are simple. Here’s why:

•Gasoline costs 2.3 to 14.8 times more than electricity to travel the same distance*

•Maintenance on an Electric vehicle is minimal

In 2009, Elon Musk, the CEO of Tesla Motors wrote, “The ownership cost of Model S, if you were to lease and then account for the much lower cost of electricity versus gasoline at a likely future cost of $4 per gallon, is similar to a gasoline car with a sticker price of about $35,000.” We’re already paying about $4 per gallon today (it varies over time). Gasoline prices are likely to go up, and with that increase in price at the pump, so does the affordability of a Tesla automobile. If the average cost of gasoline is $5 per gallon within the next 5 years, then owning a Tesla Model S, will be comparable to owning a $30,000 gasoline car. But if you’re the type of person that hangs on to your car for 7 or even 10 years, you’ll be saving much more.

*Gasoline cost range at 2.3 to 14.8 times more than electricity was calculated based on the cost per mile for a 15 mpg and a 35 mpg car using a price per gallon of gasoline of $3.75, compared to the cost per mile in the State that offers the cheapest residential electrical cost, Idaho and the state with the second to highest cost, Alaska. The price used for Idaho was 1.69 cents per mile, and 4.57 cents per mile for Alaska. The electric rates in Hawaii were not applied in that range since they are so far out of the norm with a cost of more than double what Alaska’s average electrical costs are.

We calculate the estimated cost of ownership over a 5 year period for the purchase of new 2011 or 2012 vehicle and new 2012 Tesla Model S. The purpose is to compare your estimated cost of ownership for 5 years to another vehicle you may potentially buy, to that of a Tesla Model S. You may select the list of vehicles for any specific manufacturers by clicking on the buttons below or from the pull-down list above. The the cost of ownership is calculated using the following equation:

Today, the least expensive Porsche, sells for $48,000 while a basic Toyota Camry sells for $21,000. If I told you that I’d sell you a brand new 2012 Porsche for the same price as a brand new Toyota Camry, wouldn’t you grab that opportunity in an instant?

Most people would. But what if I told you thereafter that the Porsche uses very expensive fuel and that the maintenance costs are 5 times what maintenance costs on a Toyota Camry. If you discovered that instead of spending $3,500 per year on fuel that you would have to spend $15,000, and that your maintenance costs would be $5000 per year instead of $600. At that point, you’d definitely lose interest instantly. After all, even though the car would be discounted by nearly $30,000, you would in a 5-year period end up spending $75,000 on fuel alone and $25,000 on maintenance; that’s $100,000 total!

This is of course a intentional exaggeration but it has a purpose. Its purpose is to reveal something important that most people never stop to consider. What a car costs does not matter, nor do the payments you will be making if you finance it. If someone did offer you a great deal on a car, would you even stop to consider how much it would cost you to operate it over the period that you plan to use it? I think the answer for most of us is, “probably not.”

it’s what a car costs to operate that is really the only significant thing we should be looking at. After all, most of us buy a car to use it, and then when we are done, we sell it or get rid of it, and then purchase another car. At the end of its period of use, you’re left without the car, and with only the expense you incurred in operating, that is maintaining, repairing, fueling, and the money you lost when you sold it compared to what you paid when you first bought it. If you purchase a car and only consider its sticker price or the monthly payments to determine its affordability, then you haven’t really stopped to figure out whether or not you can actually afford that car.

What if ever car had, in addition to its window sticker revealing price and options and the EPA sticker with estimated city and highway mileage, also revealed what it is likely to cost if you use it for 5 years, or 10 years? Wouldn’t that change that way we shop for cars? It really wouldn’t be so unusual. After all, every time I buy a large appliance like a refrigerator or dishwasher, it comes with a tag that says how much it is likely to cost me per year. Unfortunately that’s unlikely to happen.

What if someone offered you a very expensive car that costs almost $60,000 but told you that to fuel it, it would only cost $300 per year instead of $3500 per year. What if you also found out that at most, you’d only have to change the brakes on it every 3 to 4 years thus reducing some of you maintenance costs? You still would probably think, wait...it’s still a $60,000 car, which I know I can’t afford! But, what if you found out that despite the higher sticker price on the car, that the cost to operate it would be the same or less than the $20,000 to $30,000 car you were planning to buy? If you were told that after using the car for 5 years and maintaining it, paying for future repairs, fueling it, and thereafter selling it, that you would end up spending less money or the same money as that other cheaper car you were considering? Wouldn’t that interest you?

Which is the better deal? The car that costs $60,000 that you get to drive for 5 years after which you will have spent $32,000, or a $26,000 more budget car for which you also would still spend the same $32,000! Either way, at the end of those 5 years you would end up having spent the same amount of money, but had a completely different experience.

If we examine this, it seems that the cost to use the $60,000 car was half the price of the car, while the cost to operate the $26,000 car was almost 25% more than the cost of the car itself! So if the operating cost of a car, divided by the price of a car gives a lower number, the car is clearly a better deal.

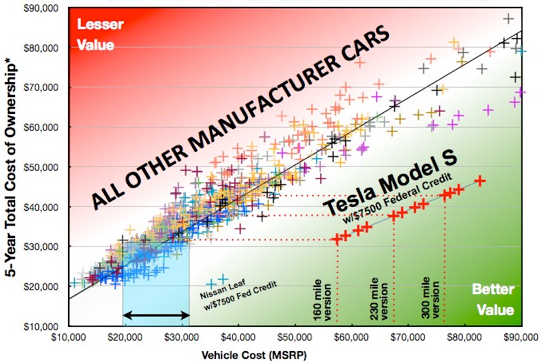

We decided to examine this for all the cars we’ve looked in Teslanomics and we discovered something very interesting. If you look at the graph above, you’ll notice that all the gasoline cars are clustered in a line that almost goes at a 45 degree angle. It seems that gasoline-fueled cars have an operating cost (depreciation, fuel, maintenance, and repairs) about equal to or 50% higher than the price of the car itself!

So we divided these two figures (operating cost/car price) and came up with an index for each car. The higher the number, the more it costs to operate, while the lower the number, the cheaper it is to operate compared to its cost. In the example above, we really were comparing a $57,400 Tesla Model S, to a $25,945 Volkwagen GTI Hatchback. If you were given the choice of driving a luxury car like the Tesla Model S or a VW GTI for the same exact costs, clearly the Tesla Model S is a better value, and that is clear in the fact that the index we obtained in dividing the car’s operating cost by its price was .58, while it was 1.22 for the VW GTI.

We call this index the CVI or the Car Value Index. When you view individual car manufacturers vs Tesla Model S in the pages here in TeslaRumors Teslanomics section, you will see in the list for each car in the right-most column which car has the lowest (best) CVI. Both the Nissan Leaf and the Tesla Model S have excellent CVI’s, and he $7500 Federal Tax Credit helps that. But since that will ultimately one day go away, we calculated the CVI without the credit and found that the Tesla Model S’ CVI still retains an excellent CVI in going from .58 to .68 while the Nissan Leaf becomes less appealing with a CVI of about 1.

Adding the estimated 5 year cost of fuel, cost of maintenance, cost of repairs, and the loss of value (depreciation) of the vehicle gives us our estimated operating costs for a vehicle after a 5 year period. Our sampling of numbers is obtained using Edmund’s TCO (True Cost of Ownership) Calculator. At this time, we are unable to account for insurance cost differences because we don’t as of yet have insurance data for the Tesla Model S since manufacturing for the Tesla S doesn’t being until mid-2012. We also are not accounting for differences in taxes and fees since those vary too much from state to state and we are estimating costs on a sample of data for only 1 zip code in Los Angeles, California. Also, we are not accounting for potential finance charges. You may add these on your own to adjust your own comparisons.

If you were to sell your newly purchased vehicle after 5 years, you’d get about the price you paid, minus that loss of value (depreciation) which occurred after that 5 year period. For the purpose of this comparison, we used 58% depreciation (initially 50%-these pages are being updated) for the Tesla Model S suggesting that the Model S would lose more than half of its value after 5 years. We think, however, that the loss of value for the Tesla Model S will be less because these cars, with their low maintenance and their cheap cost for fueling, and better styling, range and cargo space than competitor EVs will be very desirable in the used car market (as observed today with the used market for 2003 Toyota RAV4 EVs) while the resale value of gasoline-based vehicles will continue to diminish over time as they become less desirable.

CLICK ON THE MAP TO SEE ELECTRICAL CHARGING COST FOR THE MODEL S IN YOUR STATE AS WEL.L AS ESTIMATED COST PER MILE.

Copyright © 2012 Tesla Rumors.com All rights reserved.

Tesla Model X: What to Expect on Feb 9, 2012

The Signature Model S is now Sold Out!

New Car Value Index Reveals Best Deals

The Signature Model S has a $3,550 Premium

Model S Options and Pricing Observations

Modei S Options may be disclosed on Dec 15

Tesla Reinvents the Car Buying Experience

Did I realy just buy a car online?

Tesla Opens 3 News Stores in Malls

Tesla Rumors.com is not affiliated with Tesla Motors, Inc.

The Tesla Motors logo is a registered trademark of Tesla Motors, Inc.

All other trademarks are the property of their respective owners.

VISITORS